In this post, we will delve into the nuances of solar financing in Pakistan, its benefits, available options, and how you can leverage it to enjoy sustainable energy at home.

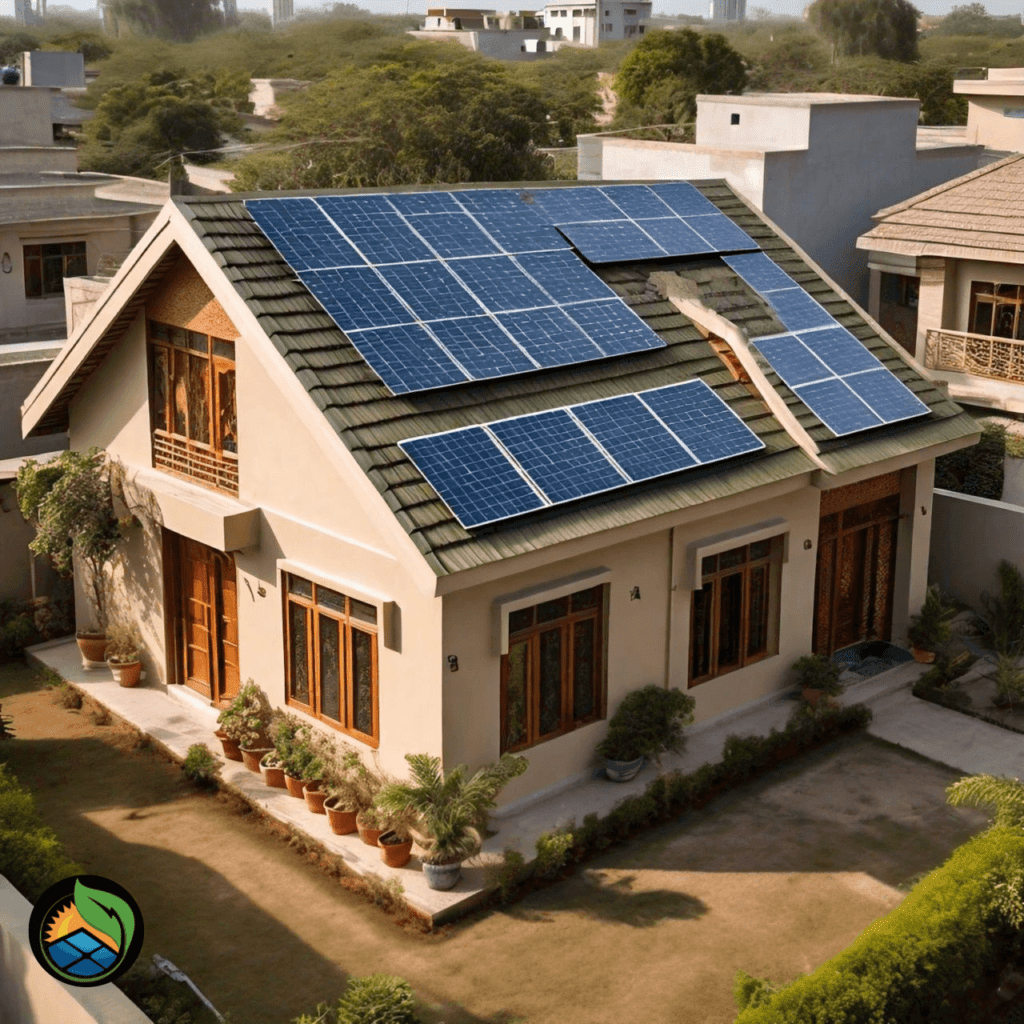

As the global community grapples with climate change and energy sustainability, solar energy emerges as a beacon of hope. In Pakistan, where energy crises are frequent, solar power offers a viable alternative. However, the initial costs of solar panels can be a barrier for many homeowners. This is where solar financing comes into play, making it accessible and affordable for the average Pakistani household.

The State of Solar Energy in Pakistan

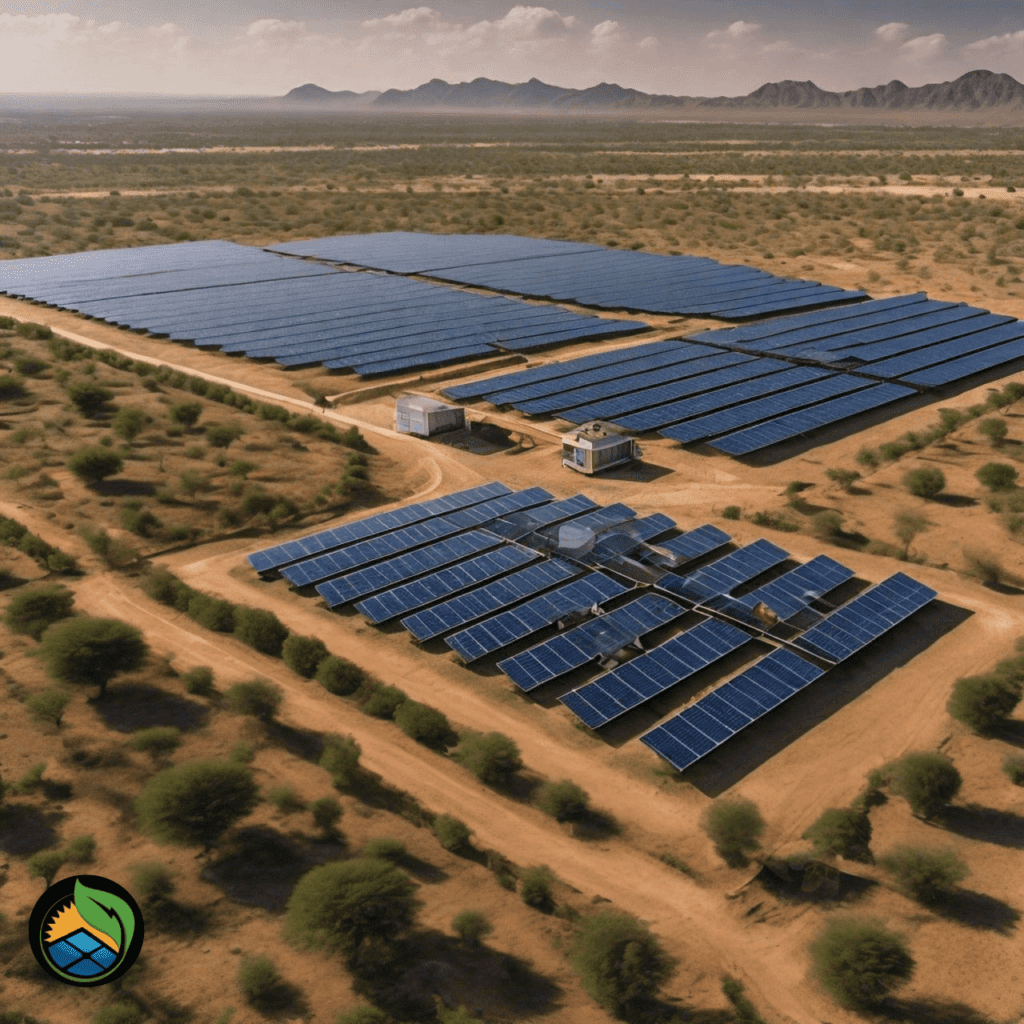

Solar energy in Pakistan has seen significant growth over the past decade. From a few scattered installations to vast solar farms, the country is slowly but surely embracing solar power. The government’s National Electric Power Regulatory Authority (NEPRA) has been instrumental in promoting solar energy, providing incentives and easing regulatory hurdles. According of recent reports, Pakistan aims to generate 30% of its electricity from renewable sources by 2030, with solar energy being a key contributor.

Types of Solar Financing Available in Pakistan

Several financing options are available for homeowners looking to invest in solar energy:

Government Initiatives

The Pakistani government, understanding the importance of solar energy, has introduced several initiatives to make solar installations more accessible:

- Net Metering: This policy allows homeowners to sell excess solar power back to the grid, effectively reducing their electricity bills.

- Subsidies and Grants: Various subsidies and grants are available to lower the initial investment costs.

Loans

Many banks and financial institutions offer loans specifically designed for solar installations. These loans typically feature lower interest rates and flexible repayment terms. Key players include:

- State Bank of Pakistan (SBP): The SBP offers financing schemes for renewable energy projects, including solar power.

- Commercial Banks: Banks like HBL, UBL, and MCB offer solar financing solutions with attractive terms.

Leasing Options

Leasing is another popular financing method, allowing homeowners to install solar panels with little to no initial cost. Instead, they pay a fixed monthly fee for the duration of the lease. This method is viable for homeowners who want to avoid the burden of upfront costs.

WHAT IS THE STATE BANK OF PAKISTAN SOLAR FINANCING SCHEME?

The State Bank of Pakistan’s (SBP) solar financing scheme is a government-backed initiative that aims to promote renewable energy, particularly solar power. Under this scheme, homeowners can avail of loans from designated banks at subsidized interest rates for installing solar panels on their properties.

Eligibility Criteria for SBP Solar Financing Scheme

To be eligible for the SBP solar financing scheme, homeowners must meet certain criteria:

- The property where the solar installation will take place must be owned by the applicant.

- The applicant must have a satisfactory credit score and financial history.

- The installed system must comply with NEPRA regulations and technical standards.

- The home’s electricity consumption should not exceed 20 kW or 95% of the sanctioned load.

- The homeowner should not have any outstanding utility bills or tax liabilities.

Scope of Solar Financing in Pakistan

The future of solar financing in Pakistan looks promising, with the government’s commitment to promoting renewable energy and increasing demand for sustainable solutions. As more homeowners opt for solar installations, we can expect to see even more innovative financing options and incentives from both the government and private sector.

LIST OF SOLAR FINANCING BANKS IN PAKISTAN

As mentioned earlier, several banks and financial institutions in Pakistan offer solar financing options. Here is a list of some prominent ones:

- Habib Bank Limited (HBL)

- United Bank Limited (UBL)

- Muslim Commercial Bank (MCB)

- Allied Bank Limited (ABL)

- Alfalah Bank

- Meezan Bank

MEEZAN BANK SOLAR FINANCING SCHEME

Meezan Bank offers a unique solar financing scheme that follows Islamic financing principles. Under this scheme, homeowners can avail of financing for up to 85% of the solar system’s cost, with flexible repayment terms of up to five years. This scheme is available for both residential and commercial properties.

Eligibility Criteria for Meezan Bank Solar Financing Scheme

To be eligible for the Meezan Bank solar financing scheme, applicants must meet certain criteria:

Salaried Individual (Permanent Job)

- Nationality: Pakistani, adult, permanent resident, CNIC holder

- Age of applicant: Minimum 20 years and maximum 60 years or up to the age of retirement at the time of maturity

- Age of co-applicant: Maximum 75 years

- Employment status: Must be permanent

- Income: Minimum monthly gross salary: PKR 100,000

- Job Tenure: Current employment for at least 2 continuous years

- Income assessment: Through payslip, bank statement, appointment letter, employment letter, and / or audited financials (in case applicant is a paid director)

- Tax payee: Must be an active tax payee with NTN number

- Credit checks: Bank will conduct bureau checks and verification of residence, office, and business place

- References: Two references required

- Financing for flats: Financing for flats / apartments is not available.

- Account in Meezan Bank: Mandatory. If the applicant currently does not have an account in Meezan Bank, it will be opened to offer financing.

- Maximum Debt Burden Ratio (DBR):

- 40% for new to industry or having a credit history less than 12 months

- 45% for customers have established history of 12 months or more

Salaried Individual (Contractual Job)

- Income: Minimum monthly gross salary: PKR 200,000

- Job Tenure: 3 years at current employer and, overall, 5 years of experience. Contract must be with direct company; third-6party contracts are not eligible

- Other aspects: Same as aforementioned for permanent job

Business Individual

- Nationality: Pakistani, adult, permanent resident, CNIC holder

- Age of applicant: Minimum 30 years and maximum 65 years at the time of maturity of financing

- Age of co-applicant: Maximum 75 years

- Income: Minimum monthly gross income PKR 500,000

- Business Tenure: At least 5 years

- Income assessment: Through Bank statements, Audited Accounts, Tax returns, etc.

- Tax payee: Must be an active tax payee with NTN number

- Credit checks: Bank will conduct bureau checks and verification of residence, office, and business place

- References: Two references required

- Financing for flats: Financing for flats / apartments is not available.

- Account in Meezan Bank: Mandatory. If the applicant currently does not have an account in Meezan Bank, it will be opened to offer financing.

- Maximum Debt Burden Ratio (DBR):

- 30% for new to industry or having a credit history less than 12 months

- 35% for customers have established history of 12 months or more

Costs Involved

| Types of Charges | Chargers |

|---|---|

| Processing Charges | PKR 5,000 + FED |

| Documentation charges | At Actual |

| Late payment charges | Nil |

| Meezan Energy Partner survey charges | Actual (if any) |

| Termination | Can be terminated anytime by paying remaining installments |

| STR Fee | PKR 1,000 |

BANK ALFALAH SOLAR FINANCING SCHEME

Bank Alfalah offers a hassle-free solar financing scheme for both residential and commercial properties. Under this scheme, customers can avail of financing up to 80% of the solar system’s cost, with flexible repayment options of up to five years.

Eligibility Criteria for Bank Alfalah Solar Financing Scheme

To be eligible for the Bank Alfalah solar financing scheme, applicants must meet certain criteria:

- Must hold the computerized National Identity Card

- Income Proof

- Utility bills of one year

- For business, you will have to provide proof of being in business for the last three years.

- Must hold the Bank Alfalah Bank account

Costs Involved

As per Bank Alfalah’s latest Schedule of Charges:

| Types of Charges | Chargers |

|---|---|

| Processing Charges | PKR 5,000 + FED |

| Documentation charges | At Actual |

| Property Valuation fee | At Actual |

| Late payment charges | 3% per month on the outstanding amount |

| Termination | Nil |

| Security instrument fee | PKR 1,000 |

Benefits of Bank Alfalah Solar Financing Scheme

- Easy and hassle-free financing for solar systems

- Flexible repayment options of up to five years

- Financing is available for both residential and commercial properties

- High financing limit of up to 80% of the solar system’s cost

- Competitive profit rates based on reducing balance method

- There is no penalty for early termination of financing (after a minimum period)

JS BANK SOLAR Financial SCHEME

JS Bank offers a comprehensive solar financing scheme for both residential and commercial properties. Under this scheme, customers can avail of financing up to 90% of the solar system’s cost, with flexible repayment options of up to seven years.

Eligibility Criteria for JS Bank Solar Financing Scheme

To be eligible for the JS Bank solar financing scheme, applicants must meet certain criteria:

- Must hold the computerized National Identity Card

- Income Proof

- Utility bills of one year

- For business, you will have to provide proof of being in business for the last three years.

- Must hold a valid bank account

Costs Involved

| Types of Charges | Chargers |

|---|---|

| Processing Charges | PKR 5,000 + FED |

| Documentation charges | At Actual |

| Late payment charges | Nil |

| Termination | Nil |

| STR Fee | PKR 1,000 |

Benefits of JS Bank Solar Financing Scheme

- Comprehensive financing for solar systems with a high limit of up to 90%

- Flexible repayment options of up to seven years

- Financing i available for both residential and commercial properties

- Competitive profit rates based on reducing balance method

- There is no penalty for early termination of financing (after a minimum period)

HBL SOLAR FINANCING SCHEME

HBL’s solar financing scheme offers customers an easy and hassle-free way to install a solar system for their home or business. With a maximum financing limit of 80% of the solar system’s cost, this scheme provides flexible repayment options of up to five years.

Eligibility Criteria for HBL Solar Financing Scheme

To be eligible for the HBL solar financing scheme, applicants must meet certain criteria:

- Must hold the computerized National Identity Card

- Minimum age requirement: 21 years

- Maximum age requirement: 65 years at the time of maturity of financing

- Income Proof (salary slip, bank statement)

- For self-employed individuals: last three year’s income tax returns with proof of business ownership

Costs Involved

| Types of Charges | Chargers |

|---|---|

| Processing Charges | PKR 5,000 + FED |

| Documentation charges | At Actual |

| Late payment charges | Nil |

| Termination | Can be terminated anytime by paying remaining installments |

Benefits of HBL Solar Financing Scheme

- High financing limit of up to 80% of the solar system’s cost

- Flexible repayment options of up to five years

- Competitive profit rates based on reducing balance method

- Financing is available for both residential and commercial properties

- There is no penalty for early termination of financing (after a minimum period)

Faysal Bank SOLAR FINANCING SCHEME

Faysal Bank offers a convenient solar financing scheme for both residential and commercial properties. With a maximum financing limit of 80% of the solar system’s cost, customers can avail of flexible repayment options of up to seven years.

Eligibility Criteria for Faysal Bank Solar Financing Scheme

To be eligible for the Faysal Bank solar financing scheme, applicants must meet certain criteria:

- Must hold the computerized National Identity Card

- Minimum age requirement: 21 years

- Maximum age requirement: 60 years at the time of maturity of financing

- Income Proof (salary slip, bank statement)

- For self-employed individuals: last three year’s income tax returns with proof of business ownership

Costs Involved

As per Faysal Bank’s latest Schedule of Charges:

| Types of Charges | Chargers |

|---|---|

| Processing Charges | PKR 6,000 + FED |

| Documentation charges | At Actual |

| Late payment charges | Nil |

| Termination | Nil |

What is included: Financing amount may include cost of solar panels, inverters, and other ancillary items such as wiring and equipment along with

Benefits of Faysal Bank Solar Financing Scheme

- High financing limit of up to 80% of the solar system’s cost

- Flexible repayment options of up to seven years

- Competitive profit rates based on reducing balance method

- Financing is available for both residential and commercial properties

- There is no penalty for early termination of financing (after a minimum period)

Muslim Commercial Bank (MCB) SOLAR FINANCING SCHEME

MCB offers a comprehensive solar financing scheme for both residential and commercial properties. With a maximum financing limit of 80% of the solar system’s cost, this scheme provides flexible repayment options of up to seven years.

Eligibility Criteria for MCB Solar Financing Scheme

To be eligible for the MCB solar financing scheme, applicants must meet certain criteria:

- Must hold the computerized National Identity Card

- Minimum age requirement: 21 years

- Income Proof (salary slip, bank statement)

- For self-employed individuals: last three year’s income tax returns with proof of business ownership

Costs Involved

As per MCB’s latest schedule of charges:

| Type of Charges | Chargers |

|---|---|

| Processing Charges | PKR 5,000 + FED |

| Documentation charges | At Actual |

| Late payment charges | Nil |

| Termination | Nil |

Benefits of MCB Solar Financing Scheme

- Comprehensive financing for solar systems with a high limit of up to 80%

- Flexible repayment options of up to seven years

- Financing is available for both residential and commercial properties

- Competitive profit rates based on reducing balance method

- There is no penalty for early termination of financing (after a minimum period)

United Bank Limited (UBL) SOLAR FINANCING SCHEME

UBL’s solar financing scheme offers customers a convenient way to install a sustainable energy solution for their home or business. With a maximum financing limit of 80% of the solar system’s cost, this scheme provides flexible repayment options of up to seven years.

Eligibility Criteria for UBL Solar Financing Scheme

To be eligible for the UBL solar financing scheme, applicants must meet certain criteria:

- Must hold the computerized National Identity Card

- Minimum age requirement: 21 years

- Income Proof (salary slip, bank statement)

- For self-employed individuals: last three year’s income tax returns with proof of business ownership

Costs Involved

| Type of Charges | Chargers |

|---|---|

| Processing Charges | PKR 6,000 + FED |

| Documentation charges | At Actual |

| Late payment charges | Nil |

| Termination | Nil |

Benefits of UBL Solar Financing Scheme

- High financing limit of up to 80% of the solar system’s cost

- Flexible repayment options of up to seven years

- Financing is available for both residential and commercial properties

- Competitive profit rates based on reducing balance method

- There is no penalty for early termination of financing (after a minimum period)

How to Choose the Right Solar Financing Option

Choosing the right financing option can be daunting. Here are some factors to consider:

- Assess Your Financial Situation: Determine your budget and how much you can afford to pay monthly.

- Evaluate Cost vs. Savings: Calculate the long-term savings from reduced electricity bills against the cost of financing.

- Research Providers: Look into different banks, financial institutions, and leasing companies to compare their offerings.

- Check Eligibility for Government Programs: Make sure you understand and qualify for any available government subsidies or net metering policies.

Step-by-Step Guide:

- Conduct a Home Energy audit Determine your current energy usage and needs.

- Get Multiple Quotes: Obtain quotes from several solar installation companies to compare costs.

- Consult Financial Advisors: Speak with financial advisors to understand the best financing options for your situation.

- Review Contracts carefully. Ensure you understand the terms and clauses before signing any agreements.

Case Studies

Case Study 1: Ahmed’s Success with Bank Loans

Ahmed, a homeowner in Lahore, utilized a loan from HBL to install a 5kW solar panel system. With a low-interest rate and flexible repayment terms, Ahmed was able to significantly reduce his electricity bills and recover his initial investment within four years.

Case Study 2: Sarah’s Experience with Leasing

Sarah, residing in Karachi, opted for a leasing option. She installed a 3kW system with zero initial costs and pays a monthly fee that is lower than her previous electricity expenses. This arrangement allowed Sarah to enjoy the benefits of solar energy without the burden of upfront costs.

Future Outlook for Solar Financing in Pakistan

The future of solar financing in Pakistan looks promising. As technology advances and costs decline, more homeowners will find it increasingly feasible to switch to solar energy. The government’s continued support, combined with innovative financing solutions from the private sector, will likely drive further growth in this sector. Experts predict that by 2030, a significant percentage of Pakistani homes will rely on solar power for their energy needs.

Conclusion

Solar financing is a game-changer for homeowners in Pakistan. It not only makes solar energy more accessible and affordable but also contributes to long-term savings, environmental conservation, and energy independence. As we move towards a more sustainable future, embracing solar financing options could be one of the best decisions you make for your home and the planet.

To explore more about how you can benefit from solar financing, reach out to financial experts and installation companies today. Take the first step towards sustainable living and enjoy the myriad benefits that come with it.